Homeownership Progress Index

The First American Homeownership Progress Index (HPRI) measures how a variety of lifestyle, societal, and economic factors influence homeownership rates over time at national, state and market levels. The individual factors can be isolated, while all other factors are held equal, to provide a unique perspective on the impact the isolated factor has on the likelihood of homeownership. The HPRI can help us better understand how to provide more opportunities for homeownership by understanding the influence of lifestyle, societal, and economic factors on the likelihood of a homeownership.

Overall HPRI and Top Markets

2020 Rankings

Yearly Change in Potential Homeownership Demand

What makes it a Homeownership Progress Index?

Traditional measures of homeownership rates do not account for shifts in underlying demographic or economic factors. Instead, they report just the share of households that are homeowners. Analysis based on these traditionally calculated homeownership rates has resulted in mistaken conclusions that are often propagated as conventional wisdom. The HPRI provides a deeper look into the changes to homeownership rates over time by accounting for, and isolating, the impact of critical lifestyle, societal and economic trends that influence the likelihood of renting or owning a home.

Why does the HPRI tell a different story than other measures?

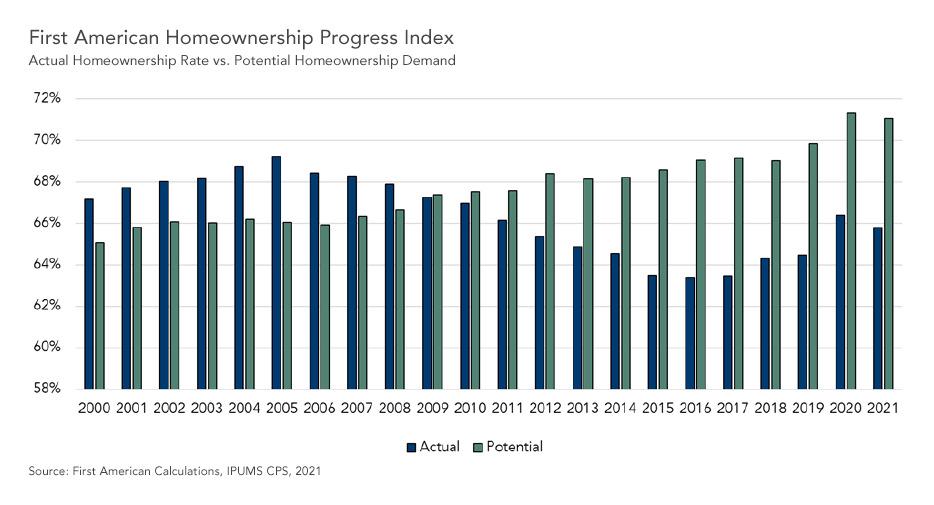

Changing demographic and economic factors either increase or decrease someone's potential to be a homeowner. For example, increasing marital rates, household size, educational attainment, income, and improving economic conditions all increase potential demand for homeownership. The HPRI measures the potential for homeownership demand based on these underlying factors. For example, the potential for, or likelihood of, homeownership may increase because of rising educational attainment or income growth. It's important to point out that the likelihood of homeownership doesn't have to match the actual homeownership rate. For example, it's possible that someone may be highly likely to desire homeownership, but are unable to find any houses they can afford to buy. In that case, potential homeownership demand would be higher than the actual homeownership rate.

What do the HPRI number values mean?

The HPRI value is the percentage of households that are likely to be homeowners, based on underlying lifestyle, societal, and economic conditions, instead of renters. Changes over time in the HPRI are caused by changes in the underlying lifestyle, societal, and economic trends. The chart below shows the HPRI over time and the corresponding year-over-year growth rate at the national level.

About the First American Homeownership Progress Index

The First American Homeownership Progress Index is an economic model that uses annual IPUMS CPS individual anonymized census survey data to measure the influence of household circumstances and demographic, societal and economic characteristics on one's choice to own a home. Demographic characteristics include age, race/ethnicity, gender, marital status and number of children. Additionally, the model includes educational attainment, income, the 30-year fixed rate mortgage rate and the unemployment rate to help explain changes in homeownership rates. The individual factors influencing homeownership can be isolated, while all other factors are held equal, to provide a unique perspective on the impact the isolated factor has on the likelihood of homeownership.

The HPRI can provide the likelihood of homeownership for a given demographic and economic profile. For example, an educated man with two children and a higher income will have a higher likelihood of homeownership than a single man without a higher education degree.

About First American

First American Financial Corporation (NYSE: FAF) is a premier provider of title, settlement and risk solutions for real estate transactions. With its combination of financial strength and stability built over more than 130 years, innovative proprietary technologies, and unmatched data assets, the company is leading the digital transformation of its industry. First American also provides data products to the title industry and other third parties; valuation products and services; mortgage subservicing; home warranty products; banking, trust and wealth management services; and other related products and services. With total revenue of $9.2 billion in 2021, the company offers its products and services directly and through its agents throughout the United States and abroad. In 2022, First American was named one of the 100 Best Companies to Work For by Great Place to Work®and Fortune Magazine for the seventh consecutive year. More information about the company can be found at www.firstam.com.

Opinions, estimates, forecasts and other views contained in this page are those of First American's Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American's business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. © 2022 by First American. Information from this page may be used with proper attribution.