First American Real House Price Index

House prices are typically reported nominally. In other words, without adjusting for any inflation. Just like other goods and services, the price of a house today is not directly comparable to the price of that same house 30 years ago because of the long-run influence of inflation in the economy. The RHPI helps provide an alternative view of the change over time of house prices in different markets across the country.

National

State

The First American Real House Price Index (RHPI) measures the price changes of single-family properties throughout the U.S. adjusted for the impact of income and interest rate changes on consumer house-buying power over time and across the United States at the national, state and metropolitan area level. Because the RHPI adjusts for house-buying power, it is also a measure of housing affordability.

Mark Explains the Real House Price Index

0:48Why does the RHPI tell a different story than other house price measures?

Changing incomes and interest rates either increase or decrease consumer house-buying power or affordability. When incomes rise and/or mortgage rates fall, consumer house-buying power increases. Traditional measures of house price affordability are dependent on the assumption of specific loan terms (down payment, LTV, DTI) and the choice of income level (i.e. median or average household income). The RHPI is not dependent on any of these assumptions and so it more broadly reflects the real price experienced by consumers regardless of their income level or the loan terms specific to their situation.

3 Key Drivers

The three key drivers of the First American Real House Price Index (RHPI) are incomes, mortgage rates and an unadjusted house price index. Incomes and mortgage rates are used to inflate or deflate unadjusted house prices in order to better reflect consumers' purchasing power and capture the true cost of housing.

Median Household Income is one of the fundamental factors determining the amount of housing a particular consumer can afford. incomes can be tracked over time to demonstrate how rising/falling incomes impact consumer house-buying power.

Interest rates drive how much a home buyer can leverage their median household income to purchase more or less housing. As interest rates fall, consumers are able to purchase a more expensive house due to lower borrowing costs. The opposite is true for rising rates.

House price levels are measured using a weighted repeat-sales house price index that tracks how prices of single-family residential properties rise and fall over time and across numerous geographies.

What do the RHPI number values mean?

The RHPI is set to equal 100 in January 2000. So, a state with an RHPI value of 110 in 2016 has seen real house prices increase 10 percent since 2000.

What does the RHPI reveal at a market level?

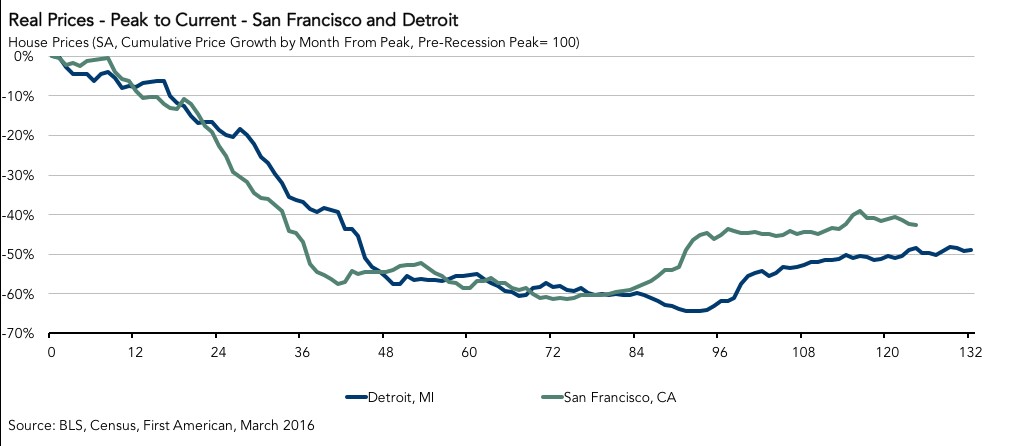

Let's consider San Francisco and Detroit and look at the RHPI for each.

Since the peak of the housing crisis in 2006, many metropolitan areas have experienced large drops in unadjusted house price levels followed by, in some cases, impressive gains. However, when measuring metropolitan house price appreciation using our consumer house-buying power adjusted Real House Price Indices, the story looks very different. For example, San Francisco and Detroit both experienced similar real price declines, about 60 percent over the course of three years, and very little "recovery" has occurred in real prices. The common perception is that San Francisco, the shining example of the new economy, and Detroit, the tarnished example of the old economy, couldn't be more different cities when it comes to housing costs. Yet, after adjusting for income growth and mortgage rates and their influence on house-buying power, real house prices in both cities remain well below the pre-recession peak. So, really how different are these two markets?

About the First American

Real House Price Index

The traditional perspective on house prices is fixated on the actual prices and the changes in those prices, which overlooks what matters to potential buyers - their purchasing power, or how much they can afford to buy. First American's proprietary Real House Price Index (RHPI) adjusts prices for purchasing power by considering how income levels and interest rates influence the amount one can borrow.

The RHPI uses a weighted repeat-sales house price index that measures the price movements of single-family residential properties by time and across geographies, adjusted for the influence of income and interest rate changes on consumer house-buying power. The index is set to equal 100 in January 2000. Changing incomes and interest rates either increase or decrease consumer house-buying power. When incomes rise and mortgage rates fall, consumer house-buying power increases, acting as a deflator of increases in the house price level. For example, if the house price index increases by three percent, but the combination of rising incomes and falling mortgage rates increase consumer buying power over the same period by two percent, then the Real House Price index only increases by 1 percent. The Real House Price Index reflects changes in house prices, but also accounts for changes in consumer house-buying power.

Disclaimer

Opinions, estimates, forecasts and other views contained in this page are those of First American’s Chief Economist, do not necessarily represent the views of First American or its management, should not be construed as indicating First American’s business prospects or expected results, and are subject to change without notice. Although the First American Economics team attempts to provide reliable, useful information, it does not guarantee that the information is accurate, current or suitable for any particular purpose. ©2022 by First American. Information from this page may be used with proper attribution.